Understanding the Medical Billing Process in Detail

There are many steps involved in medical billing processing. Here, we will explain each step in detail so that it is easy for you to understand the overall flow of information in healthcare billing.

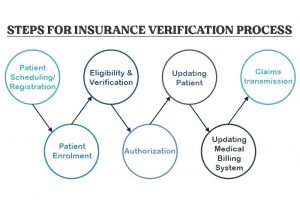

Insurance Verification

Health Insurance verification is the first process of medical billing. It’s the process to check and verify the coverage of the patient’s insurance with the company and verify the eligibility of the claims. It can be done online or by calling the insurance company. There are several ways to determine if the person has active coverage with the company.

- The insurance status can be checked by calling the insurance company customer support.

- We can use a third-party to check the insurance status online.

- Verifying insurance using a few dedicated public websites. The websites at times have the option of verifying the patient’s insurance is active or not.

- Clearinghouses can be given electronic files for a number of patients and later it’ll give the reports regarding the insurance of each person.

- Verifying the patient’s insurance by the medical billing clearinghouse.

Verifying the patient’s insurance beforehand can be very useful, as it can ensure eligibility for various benefits and avoid rework, delayed payments, the dissatisfaction of the patients.

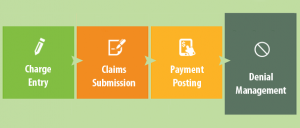

The following steps in the medical billing process are preparing the claim of insurance and sending it to the company through a clearinghouse or the payer.

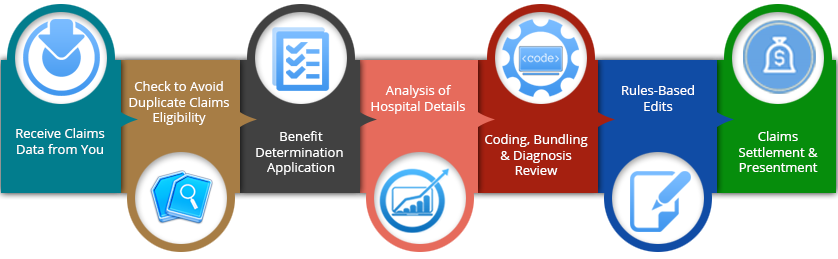

Processing of the Claims

The claim is either sent by the doctor or by the patient to the insurance company which thereafter goes through a step of accuracy, completeness check of the data. If data provided is found inaccurate or incomplete, the claim gets rejected. The reasons of the rejection could be the wrong insurance ID, address, date of birth, names, etc. The rejected claim can’t go through any further steps and the claim has to be resubmitted again with correct information.

Some of the major reasons for claim rejection

- Inactive Insurance status of the patient

- Wrong Policy number of the patient

- Erroneous code of the disease/ treatment

- Erroneous demographic data (date of birth, address, sex, age, etc.)

- The incorrect License number of the Doctor

- Wrong Modifiers

Claims Adjudication

Once the claim passes through the first phase, it enters the claim processing phase by the company. Information is scrutinized such as time of the service and the kind of treatment provided to the patient based on the reports of diagnosis. The bill gets approved if the treatment falls within the category of the treatments for that medical condition. The amount of the payment will be dependent on that specific policy and if the concerned doctor is on the list of network providers or not. This entire process could lead to three outcomes.

- Approval of the claim and the specified amount is paid.

- Denial of the claim

- The requirement of more information to have an outcome

Denied Claims

Denied claims are different from the rejected claims. The rejected claims do not even the phase of claim processing and they get rejected due to incorrect information. They can be resubmitted to be considered for approval. However, the denied claim goes through the phase of claim processing and the company decides not to pay the amount. Unlike rejected claims, denied claims can be appealed by submitting the required information or correcting the errors in the claim.

The Reasons for Denied Claims

- The billed services not falling under patient policies.

- Terminated coverage of the patient at the time of service.

- The time taken for submitting the claim from the date of services is too late. The time frame is between 90 and 180 days from the date of service.

- Incorrect date of service. The claim billing for the service differing date of adjudication

- The claim can get denied due to the missing of some of the documents like operative note or invoice.

Payment

The final step of the process is sending the appropriate amount electronically to the provider of health care or notifying the denial of the claim. The patient becomes aware of the result regardless. The explanation of benefits (EOB) letters would contain all the information regarding the payment or denial of the claim. It contains information of the maximum amount allowed to be paid and the portion that has to be paid by the patient.